Every year, Americans spend over $640 billion on prescription drugs. Yet, generic drugs make up 91.5% of all prescriptions filled - and only 22% of the total spending. That’s not magic. It’s design. Health insurers and pharmacy benefit managers (PBMs) didn’t stumble into this. They built systems specifically to push patients toward cheaper, equally effective generic medications. And it’s working - but not always the way patients expect.

How Generics Became the Default

The shift started in the 1980s with the Hatch-Waxman Act. Before that, generic drugs faced legal and technical barriers. The law changed everything. It created a clear path for manufacturers to prove their versions were bioequivalent to brand-name drugs - no need for expensive new clinical trials. Suddenly, companies could make copies of pills like Lipitor or Metformin at a fraction of the cost. Insurers noticed. They saw a chance to save money without sacrificing health outcomes. By 2022, generics saved the U.S. healthcare system $370 billion in a single year. Over the past decade, that totaled $3.7 trillion. That’s not a rounding error. That’s enough to cover the entire Medicare Part D program for over a decade. So insurers didn’t just encourage generics - they built entire benefit structures around them.The Mechanics: Tiered Formularies and Copay Traps

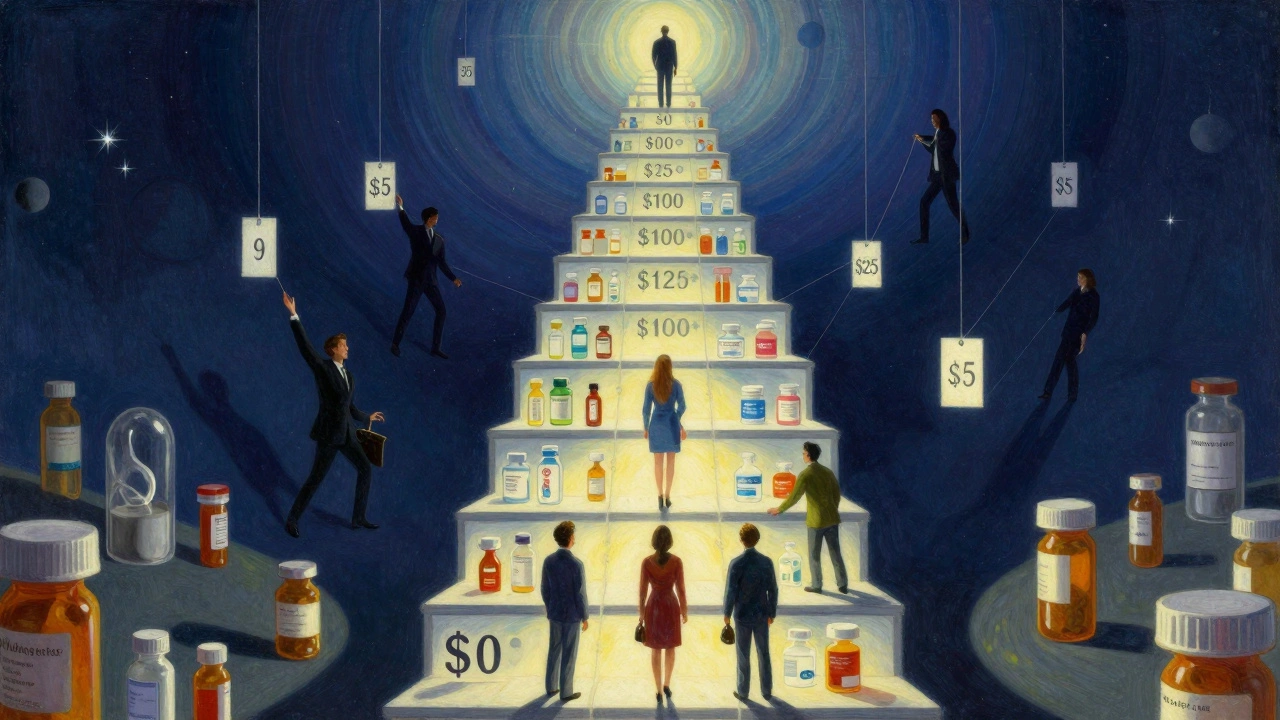

Modern insurance plans use tiered formularies to steer patients. Think of it like a pricing ladder:- Tier 1 (Generics): $0-$10 copay for a 30-day supply

- Tier 2 (Preferred Brands): $25-$50

- Tier 3 (Non-preferred Brands): $60-$100+

Who’s Really Saving Money?

Here’s the twist: patients don’t always see the savings. PBMs negotiate discounts with drugmakers and pharmacies. But they don’t always pass those savings on. In many cases, they use a practice called spread pricing. The PBM tells your insurer, “This generic costs $15.” They tell the pharmacy, “We’ll pay you $8.” You pay your $10 copay. The PBM pockets the $5 difference. That’s not transparency. That’s profit. A 2022 USC Schaeffer Center study found patients were overpaying by $10-$15 per generic prescription because of these hidden gaps. Some even paid more for the generic than they would’ve paid out-of-pocket without insurance. That’s not a feature - it’s a flaw. Medicaid programs saw 89.3% generic dispensing rates in 2022. Commercial plans? 87.1%. But in both cases, the savings didn’t always reach the patient. Instead, they flowed into PBM profits. The Commonwealth Fund confirmed in March 2025 that PBMs were keeping the difference between what insurers paid and what pharmacies were reimbursed.

What Happens When Generics Don’t Work?

Most of the time, generics work just as well. But not always. Some patients report side effects after switching - headaches, nausea, fatigue. A Medscape poll in June 2023 found 31% of physicians had patients experience adverse effects after an insurance-mandated switch. Doctors aren’t always consulted. Pharmacists can legally substitute generics without asking - in 49 states. That’s efficient for the system. But for someone with epilepsy, thyroid disease, or depression, even tiny differences in inactive ingredients can matter. The FDA says generics are bioequivalent. But bioequivalent doesn’t always mean identical in how a person feels. And when patients try to get the brand back? They hit walls. A Kaiser survey found 22% of Medicare beneficiaries had to go through prior authorization just to get their original drug. Fourteen percent said their doctor had to file multiple appeals. That’s not convenience - it’s bureaucracy.Who’s Winning? Who’s Losing?

The winners are clear: insurers, PBMs, and employers. Self-insured companies saved 9-15% on drug costs by switching to generics, according to a Johns Hopkins study. Medicare Part D saved billions. Medicaid saved $1.2 billion in 2022 alone. But patients? It’s mixed. On Reddit, a thread titled “Generic copay went from $5 to $0 last month - anyone else?” got 142 comments. Eighty-seven percent said it was a relief. But 13% said they couldn’t get certain generics because their plan didn’t cover them. Others reported paying $15-$25 more than expected because of copay clawbacks - where the PBM takes back part of your copay if the pharmacy’s price drops below your copay amount. A 2023 National Center for Policy Analysis survey found 78% of commercially insured patients would rather have a $0-$10 generic copay than a lower monthly premium. That tells you something: people understand the value - if they can actually access it.

The New Front: Transparency and Direct Pricing

The system is changing. The Inflation Reduction Act, effective January 1, 2025, capped Medicare Part D out-of-pocket costs at $2,000 a year. That’s huge. It removes the incentive for insurers to push high-deductible plans that punish patients for using expensive drugs. Also, the GENEROUS Model - launching in 2026 - will let Medicare negotiate directly with drugmakers for lower prices in Medicaid. States will have to follow uniform coverage rules. That could cut Medicaid drug spending by $40 billion over ten years. Then there’s the Mark Cuban Cost Plus Drug Company. Launched in 2022, it sells 124 generic drugs with transparent pricing: cost + 15% + $3 pharmacy fee. No PBMs. No spreads. No hidden fees. A 2023 analysis found patients saved $4.96 per prescription on average - but only if they weren’t insured. Medicaid and Medicare patients saw no savings because insurers still paid the PBM rate, not the direct price.What You Can Do

If you’re on a plan that pushes generics:- Check your formulary. Look up your drug on your insurer’s website. Is it Tier 1? Is there a preferred brand?

- Ask your pharmacist: “What’s the cash price for this generic?” Sometimes it’s cheaper than your copay.

- If you feel worse after switching: Tell your doctor. Request a therapeutic exception. Bring data. Some insurers will approve the brand if you show clinical evidence.

- Review your Explanation of Benefits (EOB). Starting January 2025, insurers must break down how much the PBM paid the pharmacy versus what you paid. Look for gaps.

The Bigger Picture

Generic drugs aren’t the problem. They’re the solution - if the system works right. The issue isn’t generics. It’s the middlemen. The opaque pricing. The misaligned incentives. The U.S. spends more on drugs than any other country. Generics are the biggest reason we don’t spend even more. But until patients see the savings directly - not just in insurer balance sheets - the system will keep feeling unfair. The future isn’t about banning generics. It’s about fixing the pipeline between the pharmacy shelf and your wallet. Transparency. Accountability. Real savings. That’s what patients are asking for. And it’s not too late to get there.Are generic drugs really as effective as brand-name drugs?

Yes, for the vast majority of medications, generics are just as effective. The FDA requires them to have the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They must also be bioequivalent - meaning they work the same way in the body. Studies show no meaningful difference in outcomes for conditions like high blood pressure, diabetes, or depression. But in rare cases - such as narrow therapeutic index drugs like warfarin or levothyroxine - even small variations can matter. That’s why some patients and doctors prefer to stick with one version.

Why do I sometimes pay more for a generic than the cash price?

This happens because of how insurance pricing works. Your copay is set by your plan, not the actual cost of the drug. Sometimes, the cash price at the pharmacy is lower than your copay - especially if you’re using a discount app or buying through a direct-to-consumer site like Mark Cuban’s. But your insurance doesn’t recognize that. You still pay the copay, and the pharmacy gets reimbursed at a rate set by your PBM. That gap is called a copay clawback - and it’s a common complaint among patients.

Can my pharmacist switch my brand-name drug to a generic without asking me?

In 49 states, yes - unless your doctor specifically writes “Dispense as Written” or “Do Not Substitute” on the prescription. Pharmacists are trained to substitute generics when allowed by law and when the drug is on your plan’s formulary. This is meant to save money, but it can cause problems if you’ve had a bad reaction to a specific generic in the past. Always ask your pharmacist if a substitution is being made, and let them know if you’ve had issues before.

Why do some insurance plans not cover certain generics?

Formularies aren’t just about cost - they’re about contracts. PBMs strike deals with drug manufacturers. If a company pays a big rebate, the PBM may put that brand on Tier 2 - even if a cheaper generic exists. That means the generic might be excluded from coverage entirely, or placed on a higher tier. It’s not about medical necessity. It’s about who paid the most. This is why checking your plan’s formulary before filling a prescription matters.

Will the Inflation Reduction Act change how generics are covered?

Not directly - but it changes the game. The new $2,000 out-of-pocket cap for Medicare Part D (starting 2025) removes the incentive for insurers to push patients into high-deductible plans that make generics seem like the only affordable option. Also, the GENEROUS Model launching in 2026 will let Medicaid negotiate prices directly, which could lower generic prices across the board. And new transparency rules require insurers to show exactly how much they paid for each drug on your Explanation of Benefits - making hidden profits harder to hide.

Do generics cause more side effects than brand-name drugs?

There’s no strong evidence that generics cause more side effects. The FDA requires them to have the same active ingredient and meet the same standards. But inactive ingredients - like fillers or dyes - can vary. For most people, that’s harmless. But for those with allergies or sensitivities, it can matter. If you notice new symptoms after switching to a generic, talk to your doctor. It’s not common, but it happens. Your doctor can request a therapeutic exception if needed.

Insurance benefit design isn’t going away. Generics will remain the backbone of cost control. But the system is at a turning point. Patients are demanding fairness. Regulators are demanding transparency. And new models are proving that savings don’t have to come at the cost of trust.

Comments

Josh Bilskemper

3 December 2025Generics are a scam disguised as savings. The FDA’s bioequivalence standard is a joke. I’ve seen patients on levothyroxine go from stable to crashing because some generic manufacturer used a different filler. It’s not about cost-it’s about control. And PBMs? They’re the real villains, not the drugmakers.

Storz Vonderheide

5 December 2025Really appreciate this breakdown. I’m a pharmacist in rural Ohio, and I see this daily. Patients come in confused because their copay went up even though the drug’s cheaper. I always tell them to ask for the cash price-it’s often half. And yeah, sometimes the generic makes them feel weird. Not because it’s bad, but because their body remembers the old one. We need better communication, not just cost-cutting.

dan koz

6 December 2025Yo this is wild but in Nigeria we don’t even have this problem. Generics are the only option and they work fine. People here don’t care about brands-they care if the pill stops the fever. The real issue is access, not pricing tricks. Y’all got too many middlemen. Cut them out, not the patients.

Kevin Estrada

7 December 2025OK but like… WHY IS EVERYONE SO NICE ABOUT THIS??? PBMs are stealing from grandma’s insulin money and you’re all just ‘ohhh interesting system’?? I had to appeal THREE TIMES to get my brand-name antidepressant back after they switched me to a generic that made me feel like a zombie. My doctor had to write a 7-page letter. This isn’t healthcare-it’s a casino.

Michael Bene

8 December 2025Let’s not pretend this is about patient care. This is corporate engineering disguised as public health. Tiered formularies? Step therapy? These aren’t clinical tools-they’re behavioral nudges designed to exploit cognitive biases. People don’t understand the math, so they assume ‘$0 copay’ means ‘free.’ But when the PBM pockets $5 and the pharmacy gets $8, who’s really paying? The patient, in dignity, in side effects, in delayed care. And don’t get me started on copay clawbacks-those are pure theft.

The Inflation Reduction Act is a bandage on a severed artery. Transparency rules? Great. But unless we ban spread pricing and force PBMs to disclose their rebates like pharmaceutical companies do, we’re just rearranging deck chairs on the Titanic. The real solution? Public drug manufacturing. Not more regulation. More ownership.

And yes, I’ve seen people on warfarin get INR spikes after switching generics. It’s not anecdotal. It’s systemic. The FDA’s bioequivalence window is ±20%. That’s not precision. That’s chaos waiting to happen.

kelly mckeown

9 December 2025i just wanted to say thank you for writing this. my mom switched to a generic for her blood pressure med last year and started getting dizzy all the time. we didn’t know why until we read this. we asked her dr for a therapeutic exception and they approved it after 3 weeks. i’m so glad we didn’t give up. also… i think i spelled ‘therapeutic’ wrong. sorry.

Tom Costello

9 December 2025One thing people miss: generics are the reason insulin isn’t $1,000 a vial. Without them, the system collapses. The problem isn’t the drugs-it’s the middlemen. And yeah, sometimes the fillers mess with people. But the answer isn’t to ditch generics. It’s to force PBMs to pass savings to patients. Transparency isn’t optional-it’s the floor.

dylan dowsett

11 December 2025And yet, people still don’t check their formularies! Seriously. I’ve seen patients get furious when their ‘$0 generic’ isn’t covered-and they didn’t even look at the plan details before enrollment. It’s not the system’s fault if you don’t read the fine print. Also, ‘copay clawbacks’? That’s not a glitch-it’s a feature. You pay for insurance, not for discounts. Stop whining.

Susan Haboustak

11 December 2025Let’s be honest: 90% of patients don’t notice a difference between brand and generic. The other 10%? They’re either neurotic, allergic to dyes, or addicted to the placebo effect of paying more. This article reads like a pity party for the privileged. If you can’t afford $10 for a pill, maybe you shouldn’t be on brand-name drugs at all. The system works. You just don’t like it.

Chad Kennedy

13 December 2025why is everyone so mad?? i got my generic for $0 last month. i’m happy. my blood pressure is fine. why do we have to make everything a drama? just take the pill. stop overthinking. also, i think the guy who wrote this works for a PBM. just saying.

Siddharth Notani

14 December 2025Excellent analysis. In India, we have 95% generic usage, and outcomes are comparable. The key difference? No PBM middlemen. Pharmacies sell directly to patients at cost-plus margins. Transparency is enforced by law. Also, generic manufacturers are required to disclose inactive ingredients. This model is scalable. The U.S. could adopt it tomorrow-no legislation needed, just willpower.

Cyndy Gregoria

15 December 2025You got this. Seriously. I used to be scared to speak up about my meds-but after reading this, I called my insurer. Turned out my generic wasn’t covered because they had a deal with a brand-name maker. I asked for the brand. They approved it. I’m not a hero. I just asked. You can too. 💪

Akash Sharma

15 December 2025This is a fascinating and deeply complex issue that touches on pharmacoeconomics, regulatory policy, behavioral psychology, and corporate governance. The Hatch-Waxman Act was a landmark in pharmaceutical innovation, but its unintended consequences have created a perverse incentive structure where the financial interests of PBMs, insurers, and manufacturers are misaligned with patient outcomes. The tiered formulary system, while economically rational from a payer perspective, introduces significant cognitive and behavioral barriers for patients who lack health literacy. The phenomenon of copay clawbacks is particularly insidious-it creates a situation where patients are penalized for the very cost-containment measures designed to benefit them. Furthermore, the variability in inactive ingredients, while within FDA tolerances, may trigger idiosyncratic reactions in sensitive populations, particularly those with autoimmune, neurological, or endocrine conditions. The GENEROUS Model and direct pricing initiatives like Mark Cuban’s are promising, but their scalability is limited by entrenched industry lobbying and fragmented reimbursement systems. What’s missing from the discourse is a unified national formulary with mandatory rebate disclosure and patient-centered therapeutic exceptions. Without structural reform, we’re merely rearranging deck chairs on a sinking ship.