When your Medicare Part D plan says you can’t get your usual medication, it’s not a mistake - it’s policy. Pharmacists can swap your prescription for another drug, but only under strict rules. These rules aren’t the same everywhere. They depend on your plan, your state, and even which pharmacy you walk into. If you’re on multiple medications, this can mean big changes to your out-of-pocket costs - or worse, a drug that doesn’t work as well for you.

What Is Medicare Part D Substitution?

Medicare Part D substitution means a pharmacist or doctor replaces one drug with another. This isn’t always a generic swap. Sometimes it’s switching from one brand to another, or from one drug in the same class to a different one. The goal? Lower costs. But the result? Confusion.

Under federal rules, plans can use formularies - lists of covered drugs - to control which medications are available and at what price. Most plans use a five-tier system:

- Tier 1: Preferred generics (lowest cost)

- Tier 2: Non-preferred generics

- Tier 3: Preferred brand-name drugs

- Tier 4: Non-preferred brand-name drugs

- Tier 5: Specialty drugs (highest cost)

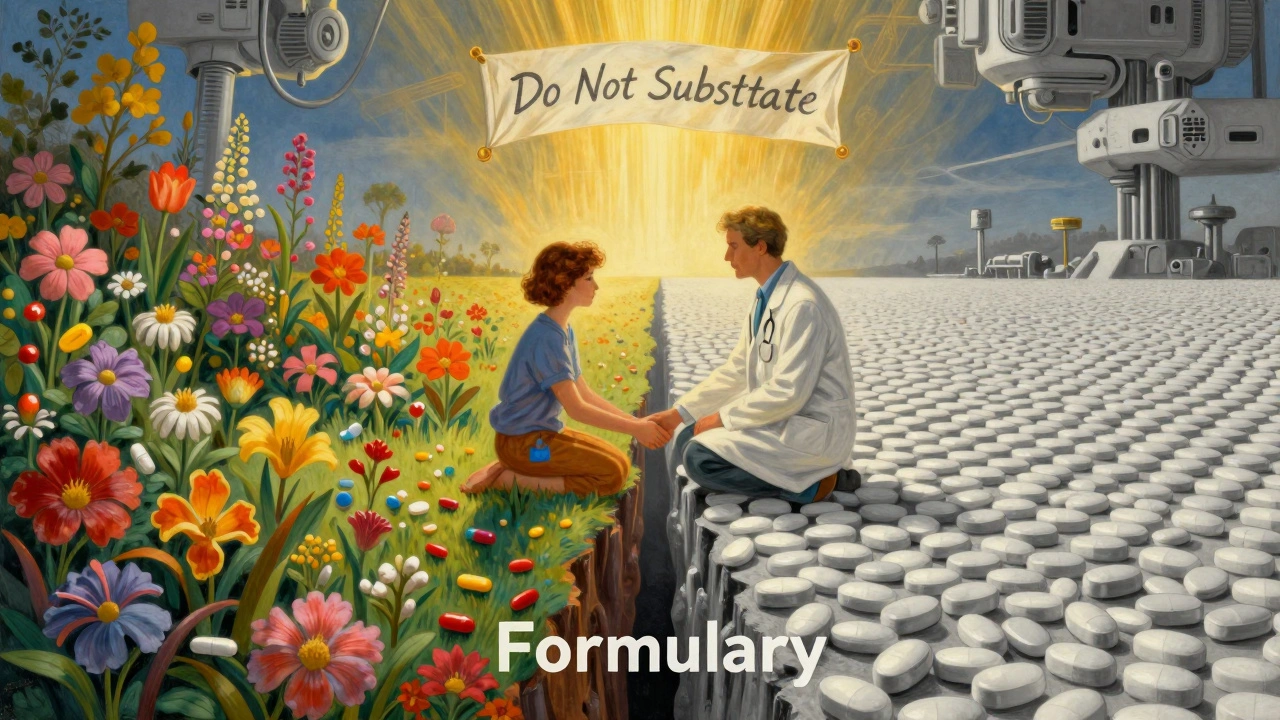

When you fill a prescription, the pharmacy checks your plan’s formulary. If your drug is on a higher tier or not covered at all, the pharmacist may substitute it - unless your doctor says no. That’s called a therapeutic interchange. But here’s the catch: not all substitutions are equal. A generic version of your drug might be fine. But switching from one brand to another? That could mean different side effects, less effectiveness, or even a dangerous interaction.

How Formularies Control What You Get

Your Part D plan doesn’t just pick drugs randomly. Pharmacy Benefit Managers (PBMs), hired by insurance companies, build these formularies. They’re not doctors. They’re business units focused on cost. That’s why some plans cover only one or two drugs in a class - even if there are 10 on the market.

For example, if you take a blood pressure medication like lisinopril, your plan might only cover the generic version. If your doctor prescribed a brand-name version, the pharmacy will automatically swap it - unless your doctor files a prior authorization request. Same thing with diabetes drugs. If your plan has a preferred insulin, you’ll pay $35 a month. If you’re on a different one, you could pay hundreds.

In 2025, the average Medicare beneficiary has access to 48 Part D plans - 14 stand-alone drug plans and 34 Medicare Advantage plans with drug coverage. But here’s the reality: not all plans are the same. One plan might cover your cholesterol drug at Tier 1. Another might put it on Tier 4 - meaning you pay 40% instead of $10. That’s not a small difference. It’s life-changing for people on fixed incomes.

The $2,000 Out-of-Pocket Cap Changes Everything

Before 2025, there was a "donut hole" - a gap in coverage where you paid 100% of drug costs. That made substitution decisions terrifying. You’d hit the gap, then suddenly your meds became unaffordable. Now, thanks to the Inflation Reduction Act, you stop paying out-of-pocket once you hit $2,000 in 2025. That number rises to $2,100 in 2026.

That changes substitution behavior. Before, plans pushed cheaper drugs early to keep you below the donut hole. Now, they don’t need to. But here’s what still matters: you pay 25% of costs until you hit $2,000. So if you’re on a brand-name drug that costs $500 a month, you’re paying $125. If you switch to a generic that costs $20, you pay $5. That’s $120 saved per month - $1,440 a year.

Once you hit the cap, you enter catastrophic coverage. After that, you pay nothing for covered drugs for the rest of the year. That’s huge. But here’s the trick: you have to spend $2,000 first. That means if you’re on expensive drugs, you’ll hit it fast. If you’re on cheaper ones, you might not reach it at all. Substitution decisions now aren’t just about cost - they’re about timing.

When Substitution Can Hurt You

Not all substitutions are safe. Some drugs are bioequivalent - meaning the generic works just as well. Others? Not so much.

Take epilepsy meds. Switching from brand-name Keppra to a generic levetiracetam might be fine. But switch to a different anticonvulsant like lamotrigine? That’s not substitution - that’s a new treatment. Same with thyroid meds. Levothyroxine generics vary in absorption. A small change can throw off your hormone levels, leading to fatigue, weight gain, or heart issues.

Patients with chronic conditions like Parkinson’s, heart failure, or mental illness are especially vulnerable. A drug swap might mean worse symptoms, more hospital visits, or even emergency care. That’s why doctors can - and should - write "Do Not Substitute" on prescriptions. But many don’t know they can. Or they’re pressured by pharmacies to avoid it.

One 72-year-old in Texas told her doctor she couldn’t afford her antidepressant after her plan switched it to a non-preferred brand. She tried the substitute. Within two weeks, she was crying daily again. She had to file a formal exception request. It took 45 days. During that time, she skipped doses. Her depression worsened. That’s not just a policy issue - it’s a health crisis.

How to Protect Yourself

You don’t have to accept every substitution. Here’s how to take control:

- Review your plan’s formulary every year. Open enrollment runs from October 15 to December 7. Don’t wait. Check if your drugs are still covered - and at what tier.

- Ask your pharmacist. When they hand you a new pill, ask: "Is this a substitute? Why?" They’re required to tell you.

- Request a formulary exception. If your drug was removed or moved to a higher tier, your doctor can file a request. It’s free. You can win.

- Use the Medicare Plan Finder. Go to medicare.gov. Enter your drugs, zip code, and pharmacy. It shows you exactly what each plan covers and how much you’ll pay.

- Know your rights. If you’re in a Medicare Advantage plan, your medical and drug coverage are linked. If your doctor says a drug is medically necessary, the plan must cover it - even if it’s not on the formulary.

Also, check if your drug has a manufacturer coupon. Humana, for example, caps insulin at $35 a month. Other companies do the same for certain drugs. You might not need a substitution at all.

What’s Changing in 2026

The Inflation Reduction Act isn’t done. In 2026, the out-of-pocket cap rises to $2,100. The catastrophic coverage phase will shift: your plan pays 60%, the drugmaker pays 20%, and Medicare pays 20%. You pay nothing.

But here’s the twist: more plans are moving into Medicare Advantage (MA-PDs). These plans bundle your medical and drug coverage. That means substitution rules might become more consistent - but also more restrictive. If your plan says you need to try a cheaper drug first (step therapy), you’ll have to go through that process for both your heart medication and your knee pain pill.

Stand-alone Part D plans are shrinking. In 2025, there are 14. In 2024, there were 21. By 2027, there may be fewer than 10. That means less choice. Less competition. Fewer options to switch if your drug gets swapped.

What to Do Right Now

It’s December 2025. Open enrollment ends December 7. If you haven’t checked your plan yet, you’re at risk.

- Make a list of every drug you take - including over-the-counter ones your doctor knows about.

- Call your pharmacy. Ask them to run your drugs through your current plan’s formulary.

- Compare that to at least two other plans using medicare.gov.

- If your drug was swapped this year and you’re not happy, file an exception. You have the right.

- Don’t wait until your next refill. If your pill looks different, ask why.

Medicare Part D substitution isn’t about saving money. It’s about control. Who decides what you take? Your doctor? Your pharmacist? Or a computer algorithm run by a company you’ve never heard of?

You have the power to ask. To push back. To choose. Don’t let a formulary make your health decisions for you.

Can my pharmacist substitute my Medicare Part D drug without telling me?

No. Pharmacists must inform you if they’re substituting a drug. They’re required to explain what the substitute is, why it’s being swapped, and how much it will cost. If you’re not told, you have the right to refuse the substitution and ask for your original prescription.

What if my drug is removed from the formulary entirely?

If your drug is removed from your plan’s formulary, you can file a formulary exception request. Your doctor must provide documentation showing why the drug is medically necessary. If approved, your plan must cover it. If denied, you can appeal. This process can take up to 72 hours for urgent cases or 30 days for standard requests.

Are generic drugs always safe to substitute?

For most drugs, yes. Generics must meet FDA standards for safety and effectiveness. But for drugs with narrow therapeutic windows - like blood thinners, thyroid meds, or seizure drugs - even small differences in absorption can matter. Always talk to your doctor before switching, even if it’s a generic.

Can I switch Medicare Part D plans mid-year?

Normally, no. The only time you can switch is during the Annual Enrollment Period (October 15-December 7). But exceptions exist: if you move out of your plan’s service area, lose other coverage, qualify for Extra Help, or if your plan changes its formulary in a way that removes all drugs in your class. You can also switch if you’re in a Medicare Advantage plan and your plan loses its contract with Medicare.

Does the $2,000 out-of-pocket cap include all my drug costs?

Only the costs for drugs covered under your Part D plan. You pay for non-covered drugs, over-the-counter meds, and drugs bought outside the U.S. Those don’t count toward the cap. Also, premiums don’t count. Only what you pay at the pharmacy - copays, coinsurance, and deductible payments - count toward the $2,000.

Final Thought: Know Your Drugs, Know Your Plan

Medicare Part D substitution isn’t a glitch. It’s a feature. Designed to save money. But if you don’t understand how it works, you’re the one paying the price - in health, stress, and time.

Know your drugs. Know your plan. Ask questions. Don’t assume your pharmacist has your best interest in mind. They’re following rules set by a company that doesn’t know your medical history. You do.

Comments

john damon

12 December 2025OMG I just got switched to a generic for my thyroid med and I felt like a zombie for 3 weeks 😫😭 my pharmacist didn’t even tell me until I noticed the pill looked different. WHY DO THEY DO THIS???

Monica Evan

12 December 2025Yikes. I’ve been there. My mom got swapped from her brand-name seizure med to a generic and her seizures doubled. She had to fight for 45 days to get it back. Pharmacists are supposed to tell you but half the time they don’t. And doctors? They’re overwhelmed. You gotta be your own advocate. Check your formulary every year. Even if it’s boring. Even if you’re tired. Write down every med you take - including the OTC ones. And don’t be shy to say ‘no’ to a swap. Your life isn’t a spreadsheet.

Taylor Dressler

13 December 2025Monica is absolutely right. The system is designed to cut costs, not optimize outcomes. But patients can and do win formulary exceptions - I’ve helped over 20 seniors appeal substitutions in the last year. The key is documentation: your doctor must write a letter stating medical necessity. Most plans approve within 72 hours if it’s clearly tied to safety or efficacy. Also - always ask if the substitute is bioequivalent. For drugs like warfarin, levothyroxine, or lithium, even 5% variation can be dangerous. The FDA allows generics to vary by up to 20% in absorption. That’s not trivial.

Aidan Stacey

15 December 2025THIS IS A NATIONAL CRISIS. I watched my uncle die because they swapped his heart failure med for a cheaper one. He was stable for years. Then BAM - new pill. Three weeks later he was in the ER. They said ‘it’s the same class’ - but it’s not the same drug. It’s not the same body. It’s not the same life. And now? They’re pushing more Medicare Advantage plans that bundle everything - meaning one algorithm decides your insulin, your blood pressure pill, and your antidepressant. We’re turning healthcare into a game of Tetris. And we’re letting corporations win. Someone’s gotta stop this.

Jim Irish

16 December 2025The $2000 cap helps but doesn't solve the root problem. Substitutions are still happening without adequate patient education. Many seniors don't know how to check formularies or file exceptions. The system needs better outreach. Not just links on websites. Real phone support. In-person help at senior centers. This isn't just policy. It's dignity.

Lisa Stringfellow

17 December 2025Wow. So what? People complain about everything now. If you can’t afford your meds, maybe you shouldn’t have taken them in the first place. The system works fine. You just don’t like being told what to take. Get over it. There are cheaper options. Use them. Or don’t take the pills. No one’s holding a gun to your head.

Eddie Bennett

18 December 2025Lisa’s got a point - kinda. But also… no. I’m 68. I’ve been on 5 different Part D plans since 2018. I’ve had my meds swapped so many times I keep a little notebook. I know how to fight. But my neighbor? She’s 82. Doesn’t use a computer. Doesn’t know what a PBM is. She just takes what they hand her. And then she wonders why she’s dizzy all the time. This isn’t about being lazy. It’s about access. And if we don’t fix it, more people will get hurt. Just saying.

Doris Lee

20 December 2025Hey everyone - I just used the Medicare Plan Finder and found a plan that covers all my meds at Tier 1 for $12 a month. I switched before Dec 7. Best decision ever. You can do it too. Don’t wait. Don’t stress. Just go to medicare.gov. Take 15 minutes. Your future self will hug you. 💪❤️